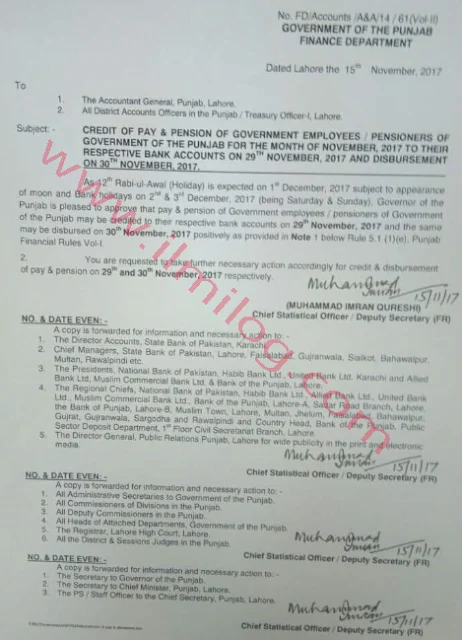

Punjab Government Finance Department has issued a notification No. FD/Accounts-A&A-14/61(Vol-I).It has updated on 15-11-2017. This is about Pay and Pension 2017 for the Month of November Government workers of Punjab.

Notice of Pay and Pension 2017 for the Month of November Government workers of Punjab

Pay and Pension 2017:

Subject: Credit of Pay and Pension 2017 of Government workers and Pensioners of Government of Punjab. It is for the Month of November 2017 to their separate financial balances on 29th November 2017 and payment on 30th November 2017.

As 12 Rabi ul Awal (Holiday) is normal on first December 2017 subject to appearance of the moon. Bank occasions may exist on second and third December 2017 (being Saturday and Sunday). The Legislative head of Punjab has satisfied to affirm Pay and Pension 2017 for the Month of November Government Employees of Punjab. They have credited to their separate ledgers on 29th November 2017 and dispensed on 30th November 2017.

اردو میں تفصیل کے لیےنیچےلنک پر کلک کریں

http://bit.ly/2io6QQ5

Notification of Pay and Pension 2017 for the Month of November Government Employees of Punjab

It hasn’t sufficient to take off another agonizing round of annuity cost builds slated to hit government spending plans in 2019. The Legislature will presumably defer any genuine discussion about changes to benefits. It has for as far back as three years. Gov. Kate Brown, for one, says she’s not prepared to discuss the primary advantage change thought available for use.

However, she talks reinstituting some level of worker commitments to the annuity support. Meanwhile, she has another arrangement, or two designs really. The first would divert a cut of state incomes to balance the annuity expenses of K-12 schools, junior colleges, and colleges.

The second includes tempting the 900 or so open businesses who take an interest in the framework to shake their couch pads, distinguish save assets and store them in accounts at PERS. All the while, they would bet that the benefits store’s speculations will produce higher returns than the low and to a great extent the free returns those dollars acquire today in the short-and medium-term reserves oversaw by the Oregon Treasury. Verifiably, that has been a decent wagered.

Be that as it may, it’s no certain thing. The Public Employees Retirement System prepared this fall, unwinding essentials and decreasing expenses on government managers, to make additional stores. Those assets would go into “side records” that are contributed close by annuity resources.

.png)